Our family is days away from fully funding our six month emergency fund. We never thought we’d be here, but we can look back on this financial journey and say with satisfaction that it honestly wasn’t as hard to save this money as we once thought.

When it comes to saving money, the little things really do count. Just like using snowflakes to pay off debt, piling up those small chunks of change somehow transform into a decent amount of money.

Two years ago, we would have looked at the math and assumed it would take us two years to save a six-month emergency fund. Instead, it took us four months. And our biggest contributor was piling away all those little chunks of change.

The Latte Factor

We still had dates, and we would still hang out at our neighborhood coffee shop. But not often. Definitely not as often as we could afford.

Consider this — let’s say the average gourmet latte is $4. And as a busy mom, you really only have time to grab one about three times a week, between running errands, or during that occasional treat when you can sit down with a friend and chat. That’s around $48 a month. Simple math will show that this latte indulgence costs $576 annually.

Ouch.

Don’t get me wrong — I really do love getting out and sipping gourmet coffee. Truly. I write my book from a coffee shop about twice a month. But since we buy quality beans and brew our own java at home with a French press, we don’t feel the need to leave our home often to get a decent cup. And that has saved us quite a chunk of change.

Less Java, More Maturity

One of the best side effects to financial progress is increased inner maturity, and part of this inner maturity is learning the value of saying “no.” I’m not saying our family totally has our act together. I still get weak in the knees over a beautifully-scented candle. I have more things favorited in Etsy than I have time to shop. But as a family, we’ve seen the value of saying no with our own eyes.

When you see how much those little things here and there add up (called “gazingus pins” in our book club’s first read, Your Money or Your Life), it’s much easier to pass on its momentary satisfaction. I’m fine with quality-brewed coffee at home.

It’s easy to feel overwhelmed when you know you need to save, but you’re not sure how much and what for. It’s much easier and less stressful to make smaller, reachable savings goals as a family — and this also makes it much easier to pass on your latte. Or whatever it is for you.

Here are some keys that made it possible for us to save so quickly.

1. Make a plan.

As a couple, my husband and I decided we wanted to save X amount by X date. We’d do the math often, and track our progress when we could. We didn’t obsess, but we kept watch regularly.

2. We named the savings goals.

Our first goal was a six-month emergency fund , which was for any and all household emergencies. A broken radiator, unforeseen car repairs, things like that. Christmas isn’t an emergency, because it’s on December 25 every year, and we know it’s coming.

We’ve named our next goals as well — a long overdue family vacation, which we’re taking in November, then a car fund, and then a house down payment fund. All with a set goals of X dollars by X date.

3. Make it easy to allocate the funds.

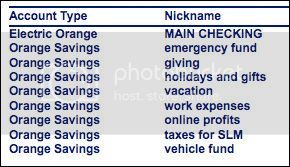

I truly do love the ease of ING Direct, because we can have unlimited savings accounts and name them according to each of our savings goals or our regular sinking funds. We have our Electric Orange checking account with a debit card, which we use to transfer money from our many ING savings accounts whenever we need to use those funds.

A screenshot of our accounts at ING:

We can also have an unlimited amount of automatic transfers, so that once we have everything set up, it’s virtually brainless. And because everything is online, we get slightly higher interest rates than with a traditional brick-and-mortar bank, and it’s incredibly easy to keep up daily with our funds.

I recommend them highly as your family’s main savings base. Their customer service is super friendly and helpful as well.

4. Save your lattes.

Your latte factor — whatever it is on which you spend little chunks of money on a regular basis — can make a serious dent in your savings goals. $576 per year on top of what you set aside regularly for savings adds up to — well, quite a bit.

To curb your latte factor automatically, transfer $12 per week into your current goals’ savings account.

It’s not easy, but it’s simple. When you make bite-sized financial goals, they’re much easier to digest. Get out of debt one day at a time, then start saving for your goals. Make it easier with a great French press.

What are your savings goals?

top photo source