So… budgeting. Several of you have mentioned wanting to see our family’s budget. I’m happy to show you what we do, though I have to admit — it’s nothing fancy.

Charlie Park blew me away with last week’s post about warm and fuzzy budgeting. He’s right — it’s nothing more than hopes, and goals, and dreams … on paper.

A budget can sound so boring, and it’s easy to assume you can live without it. Well, if a budget is simply telling our money where to go, I propose that we all live by a budget — we simply see it clearer when we write it out on paper (or digitally).

So — write out your budget. You’ll feel much more in control of your money.

Here’s how we do ours.

A zero-based budget

We use a simple zero-based budget method, which means:

expenses – income = $0

And yep, we use Pear Budget, the brain child of Charlie Park. There are lots you can use, but I like it because it’s easy to use and it’s pretty. Below, all the screenshots are from my own Pear Budget account.

1. Income

First, we list out all our projected income.

This is pretty simple, but it’s important to remember all your income. Birthday checks from Grandma count. Did you finally get paid back from your work from when you bought office supplies? That counts, too. If we have extra from last month — as in, we didn’t quite budget correctly last month so we have a few dollars extra to carry over — we consider that income to be budgeted this month (it usually gets allocated to savings).

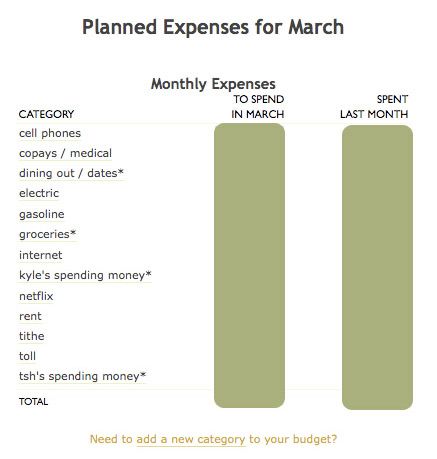

2. Regular Expenses

Next, we list out our regular, monthly expenses. These are — well, expenses we have every month.

• The ones with asterisks mark our cash envelope system — as in, we withdraw money for these items and put them in separate envelopes. The rest, we have automatically deducted from our account.

• We always take at least 10 percent off the top and have that automatically transferred to our separate “giving” savings account.

• Our “spending money” categories are our free spending cash. Coffee, a new book, fabric for a sewing project — we can spend it on whatever we want. Knowing we have a certain amount allotted each month means we don’t feel handcuffed to a strict budget.

• When we still had debt, we paid it off as a regular monthly expense using the Debt Snowball method. It would show up here as a line item.

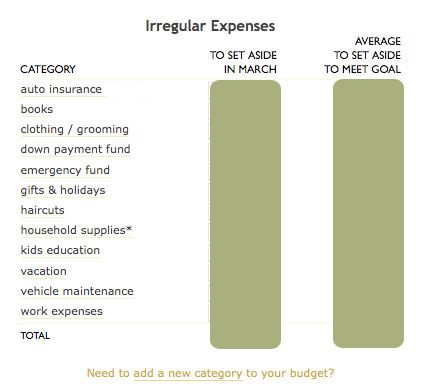

3.Irregular Expenses

These are our sinking funds. our expenses we don’t necessarily have every month. But we often set aside a regular amount in each of these every month, letting the accounts build up slowly over time.

When we decide on an exact amount we need, such as for auto insurance, we simply divide the total amount by the months we have until the bill is due. Once it’s filled, we pay the bill. Then we start again.

When we’re aiming for a certain goal a la Baby Steps, we throw as much money towards that line item until our goal is reached. So while we’re replenishing our Emergency Fund, the majority of our money is thrown there. When we’re done, we’ll move on to our Down Payment Fund.

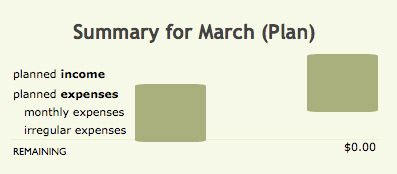

4. Summary

As a good zero-based budget should, our income minus the expenses equal zero.

See that $0.00? That means we took what we’ve expected to earn in March, and allocated all of it into different line items.

Skinning a cat

In sharing our family’s budget, I’m not saying you have to do it this way. This is just one way to do it. Our salary arrives monthly, so our budget is pretty easy to plan (that will change this summer). If you get paid every other week, your budget might be slightly different.

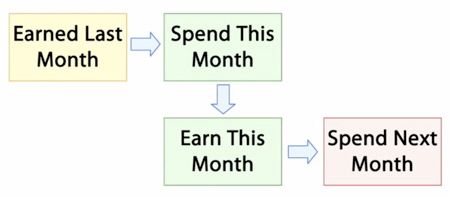

If you depend on an irregular income all together — as in, you don’t really know what you’ll bring in from month to month — you might want to slowly work towards living on last month’s income. Every month for a season, set aside every extra penny you can into a sinking fund with the goal of a total of one month’s worth of expenses. It won’t be easy, but if you sacrifice for a few months, it’ll add up faster than you think. Once you have these funds, you can then start living on these funds while working in the present for next month’s expenses.

Currently, all my SLM revenue goes to our Baby Steps. If one day, Lord willing, we can start living off this irregular revenue, we’ll move to this plan — living off last months’ income while earning next month’s.

The takeaway

We’ve been talking a lot about money management this month — having a long-term plan, making slow, methodical Baby Steps to reach them, and wielding the power of a budget for your family’s benefit.

We’ll keep talking money this spring, especially as we focus on our big picture, lifelong goals of living simpler and with more intention. On Friday, we’ll talk about what this money management has to do with Project: Simplify (you are joining us, aren’t you?). I love your suggestions for money topics to tackle — keep ’em coming.

How do you budget? What has been your biggest financial success because of planning with a budget?