This giveaway is now closed. Check here for the winners!

Phew. I admit it… I’m glad Project: Simplify is over. Don’t get me wrong — I was so inspired by all your hard work, and I’m happy with the results in my own home. But after five weeks of writing about home organization, I’m ready to explore another topic. Plus, I still need to visit a lot of your websites and check out your before-and-afters.

Before Project: Simplify, we talked money. From redefining a budget, to reiterating why being debt-free means withstanding the tidal waves, to showing you how my family budgets, we covered a lot about the green stuff.

Today, I thought it would be fun to sort-of merge the two recent topics — organizing and money — and share why I think the two go hand-in-hand. How does having a simplified, more organized home help you manage your finances? And how does taking care of your money help you simplify your home? Do the two even have anything to do with each other?

I definitely think so. Here are 5 ways keeping your home simple and clutter-free helps you manage your money — and how staying on top of your finances also helps you create a more peaceful home.

PLUS, I’ve got a sweet giveaway at the bottom of the post.

1. When you keep your home less cluttered, you know what you have.

Have you ever bought something you knew you had, but you just couldn’t find it? Or even worse — you didn’t realize you already bought it until you found an item identical to something you just brought home?

When you regularly purge, you’re allowing everything you own to have a specific place. And when things have a place where they belong, it’s easy to keep inventory of everything you have. Knowing exactly what you have means spending less on purchases you don’t need.

Plus, there’s this weird thing that happens when you start purging — you sorta like not having a lot of stuff. You mentally weigh a potential purchase in the store — “Do I really want this thing to take up residence in my home?” It may look lovely on display at the store, but really, it just adds clutter at home.

2. When there’s a place for everything — such as the bills and financial statements — it’s easier to pay on time.

When bills and envelopes are scattered hither and yon, it’s really hard to know what’s due and what you’ve paid. Keeping a home with less stuff means your bills aren’t competing for attention.

Even better — go paperless with as much as you can, and not only are you keeping your home neater, you’ve got your payment records at your fingertips.

3. When you’ve got a goal to be debt-free, selling your extra stuff brings you closer to your goal.

Choosing to become debt-free often means doing crazy stuff — selling your toys, ditching restaurants for awhile, maybe even selling a car or two. But an easier way to make a good chunk of cash is to sell those little things you just don’t need.

Craigslist, eBay, consignment shops, yard sales, whatever… Selling stuff means a wad of quick cash you can put towards debt (or any other financial goal), but it also means a less cluttered home. I’m a decluttering maniac and purge often, and I still managed to gather seven large containers of stuff for my upcoming yard sale.

4. When you create a monthly budget, you can afford those bigger, higher quality items that last longer.

This was a surprising one for me. When we started living on a monthly, zero-based budget where every dollar had a name, we noticed how much money we frittered away on lattes and magazines. So we made sure we had a “personal money” line item for both Kyle and me, and both of us could spend this money on whatever we wanted, every month. If one of us wanted a venti latte, we could spend this money and not blow our budget for the month.

This then meant it was easier to save up for bigger purchases because we were more mindful of those little “gazingus pins.” After we saved up for our fully-funded emergency fund, we saved up for a few more months and took a vacation to Paris. That trip meant way more to me than any random issue of Better Homes & Gardens.

And that trip didn’t add one iota of clutter to our home. We spent our money on fantastic French food instead of miniature Eiffel Tower paper weights.

5. When you talk money regularly with your spouse, your relationship is more unified (and your home is less cluttered).

As I find something I like on Amazon, I add it to my shopping cart. After I have a pile of potential purchases, I ask Kyle if he needs anything before I check out.

“Um, honey…,” I hear from the kitchen table. “Do we really need more school clothes for Tate? The school year’s almost over.”

I think for a second. “Huh — yeah, you’re right. Never mind. I’ll take that out of the cart.”

Kyle and I couldn’t have become debt-free, live on a monthly budget, or save up for specific long-term goals without talking with each other constantly. We have weekly family “business meetings,” but we also talk near daily about money. Nothing major — just updates or thoughts about our financial status. It’s a regular part of our life, so talking about money isn’t a big deal to us at all.

This means we decide on things together. Neither of us makes a major purchase without talking to the other. We both decide whether we need a new chair, more towels, or another board game for the kids. We don’t hold a senate committee on this stuff (nor do we have to shut down due to ridiculous indecision), we simply listen to each other and decide on a quick “yay” or “nay.”

Regular financial communication increases our marital intimacy on all levels. And we keep each other accountable from bringing in needless stuff to our home. Two minds are better than one here, and it helps us keep clutter at bay. It’s awesome.

Financial Peace University

I talk about Dave Ramsey quite a bit — here on the blog, in my book, Organized Simplicity, and in my real life, too. Two weeks ago I attended his EntreLeadership course. I guess you could say I drank the Kool-Aid, but this isn’t because I’m blindly following some guy with a radio show — it’s because Dave’s ideas are simple and they just make sense.

And because I’ve seen, first-hand, how his principles can revolutionize your financial life. I’m not a numbers person, and have never really been “good with money.” But by following his Baby Steps, Kyle and I are debt-free, we saved up for a fully-funded emergency fund in four months, and we took our first family vacation ever (with cash, of course).

And then, when we had to make a sudden move back to the States and set up a new home, it nearly wiped out our savings — but we didn’t sink back into debt. We stayed afloat. And I’m thrilled to say that as of last month, we replenished our fully-funded, six-months-of-savings emergency fund, and we’re back on track.

Yes, you’ve got to stick with it, and as Dave says, you’ve got to live like no one else, so later you can live like no one else. So far, it’s totally worth it.

I had the honor of meeting Dave a few months ago in Nashville, and today, I’m thrilled to tell you that his team wants to give FIVE Simple Mom readers a Financial Peace University membership!

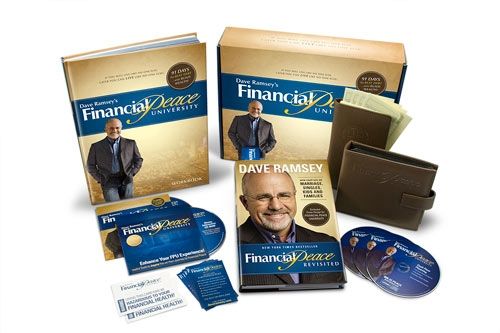

FPU is a local, 13-week class hosted in tons of locations around the U.S. and Canada. For $109, you are enrolled in a local class that covers topics such as how to get out of debt, what mutual funds are and how they work, and what kind of insurance you really need. You’ll also receive a workbook, an audio CD library of all 13 lessons, an envelope system wallet, access to the Member Resource Center, and Dave’s best-selling book, Financial Peace Revisited. Plus, this is a lifetime membership — you and your spouse can always attend an FPU class anywhere, any time, at no extra charge.

FPU Giveaway!

Five of you will win a lifetime membership to FPU. Here’s how to enter:

Leave a comment on this post, answering this question: What is your biggest money challenge?

(if you’re reading this in an email, you must click over to the post to comment)

Additional entries

You can enter two more times — here’s how:

1. Mention this giveaway on Twitter, including @simplemom, @daveramsey, and the URL of this post — http://bit.ly/eFC3r7. Then come back and leave an additional comment on this post, telling me about your tweet.

2. ‘Like’ Simple Mom on Facebook and Dave Ramsey on Facebook. Then come back here again and leave a comment, telling me you did so.

This giveaway will end on 11:59 p.m. this Friday, April 15, and I’ll announce the winners this weekend. I hope you win!