Often, introductions to budgeting make it sound soooo simple: “What do you make each month? Divide it up. Boom! Done!”

There are a number of flaws with that — you probably don’t know what you actually spend money on, you probably aren’t factoring in that dishwasher that’s about to die, you’re gonna fudge your numbers to make the total expenses fit the income number, and so on. But there’s one problem that hits a lot of people in the very first sentence of those instructions. “What do I make each month? Well … which month?!?”

When you make a different amount of money each month, it can be very difficult to budget your expenses.

How will you know whether you can buy those shoes you need this month? Will you need to cancel that haircut? Do you really have to go see the doctor about that cough right now, or can it wait a few weeks? It’s what I call “budgeting in the dark” — you don’t have all the facts, which means you’re trying to make rational decisions through an irrational process.

Budgeting in the dark is no fun, and it’s one of the reasons a lot of people completely give up on budgeting. (Pro tip: that’s not going to make things better.)

Today we’re going to look at how to throw some light on the situation, how to get things under control, and how to drop that bucket of stress you’re probably carrying around with you.

The Dam and the Water Tower

Before we get into talking about money, I want to touch on something else. Water.

Cities have people. People need water. Unfortunately, there aren’t many places in the world where the amount of water needed by the city magically shows up each morning, ready to be used for cooking, cleaning, and watering gardens. No, cities have to plan for their water usage. And while there are lots of ways that cities can manage their water, the two most visible ways are through dams and water towers.

With a water tower, a city pumps water in every single minute of every single day, filling the water level higher and higher. Then, at peak moments — like 6-8am and during the halftime of the Super Bowl (or, I guess, during the actual game) — all the people in that neighborhood start using the water, and it drains out of the tower. Then, slowly, the pumps fill it back up and the cycle repeats. Think: a little bit of water in, steadily and constantly, means it’s there when it’s needed.

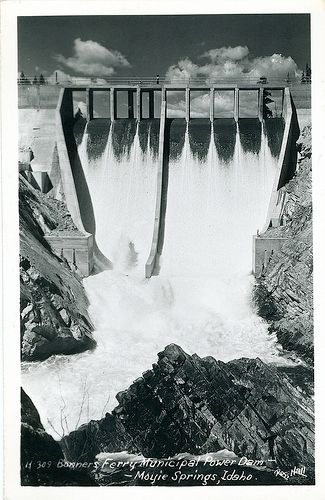

Dams also provide water to cities, but they do something else as well: flood and drought control. Sometimes, spring rains come, the snows melt, and a lot of water comes rushing down the river towards the city, and it needs to be contained. Other times, rains are light, the summer sun is hot, and not as much water flows down. In both cases, a dam — and the reservoir of water it holds — helps regulate the level of water the city has access to.

You’ve probably made the mental leap already, but dams and water towers are perfect metaphors for you and your money. But I said we’d be specifically talking about irregular incomes. How does this metaphor apply?

Step 1. Create a “reservoir” (open a bank account)

Some of you make the same amount of money every month. You should think of your money flow like a water tower. Or, actually, a collection of water towers. Each month, you push a little bit of money into the “groceries” water tower and the “clothing” water tower and the “replacement dishwasher” water tower. Then, as you need it, you draw down on the money that’s collected and you get the thing you need.

Then, when more money comes in the following month, you push it into the water towers again. If you’re a “cash-only” household, your envelopes are your water towers. If you use credit/debit cards as well, you might use a couple of different bank accounts for that. Tsh talks more about that in her post on “sinking funds.”

Those of you with irregular incomes need to add a step into your process. You’ll still use water towers, but you also need a dam somewhere to feed them. I recommend setting up a new bank account — the “Orange” accounts at Capital One 360 are good for this, but you might prefer a local bank or credit union with bank tellers you can interact with directly — to act as your “reservoir.”

Money goes from your paycheck to your reservoir, then from the reservoir to the water towers, and then you’d spend it. You won’t ever actually spend money directly from this “reservoir” account. You’d also get to say things like “Oh, we need more dam money.”

Step 2. Fill up the reservoir (Gather money into this account)

So we’ve opened up the bank account to act as your reservoir. But it’s currently empty. That’s okay. A dam doesn’t start out on Day 1 full of water. Similarly, you’ll need to gather money into this account. It could take a few months. (While that’s going on, that’s a great time to track your spending if you aren’t already doing that.)

You should make it a habit to put some money from every check that comes in into this account. The goal is to end every month with a little more money in this account, and, eventually, to have a little more than a full month’s worth of expenses stashed away here.

Getting to that point can be tricky, and I don’t mean to suggest that it won’t take some work. But the peace you’ll have when you get there will more than make up for it. One thing you’ll want to do is to “ration your water use.”

In a drought, cities employ “water rationing” — they basically figure out what uses of water are necessary and which ones are simply nice to have. In the same way, as you’re building up your reservoir, think about which of your expenses are needs, and which ones are wants. Sometimes you even need to divide a single expense category up — maybe you need to have “groceries – needs” and “groceries – wants” categories. Tsh actually goes more in-depth on this in a post she wrote a few years back, How Do You Budget On An Irregular Income?.

Step 3. Draw Water from the Reservoir (Pay yourself out of this account, not directly from your paychecks)

There are two ways you can go about this. One way is to figure out what, on average, you make each year, and to give yourself a regular “salary” out of your reservoir. The other way is to only pay yourself what you brought in the month before.

If you give yourself a regular “salary” out of your reservoir, you simply transfer the same amount out from one month to the next. Sometimes your reservoir will dip down a bit (if your income has been light). Other times, it’ll get a bit high (when you’ve been making more than usual). Either way, though, you should only pay yourself the same amount every month.

If you go with the “pay yourself what you brought in last month” approach, your reservoir will probably end up staying at about the same level. It’ll fluctuate up and down, but if you’re drawing that money out, it’ll all balance out in the end. My friend Jesse, at YNAB, encourages this approach, and many people find it works well for them.

Planning for the Future

So if you’ve gone through these three steps, and you have your “reservoir” account ready to go, where do you go next? In truth, you’re now ready to follow just about every other (good) budgeting article that’s out there. You’ve created a way to regulate the money that flows in each month. You’ve pulled yourself out of the dark, and can now make good decisions and have a less-stressful plan as you move forward.

For those of you in this situation, good luck with it. And in the comments, we’d love to know: Are there any tips you have for working with an irregular income? What other obstacles stand in the way of you feeling peace about your finances?