I loved reading everyone’s responses to their most common financial frustrations. I’m not saying I love that many of you have these frustrations, of course, but it is helpful for me to see where this community is financially, and how we can possibly help each other on a solid road to financial freedom.

There were many common issues—how you and your spouse can get on the same page, how to handle retirement and saving for kids’ college, and how on earth to make a budget that’s stick-able.

But first I thought I’d recap our family’s financial road map—how we’re currently managing our money.

None of it is rocket science, but that’s what makes it so beautiful—it’s common sense. It’s a financial plan everyday Janes and Joes can follow. No finance degree required (trust me — I’m horrible at math).

Find your why

Before you decide your financial game plan, you need to have a reason for doing what you do with your money. And it’s important that your “end” reasons not be “means”—getting out of debt isn’t a good long-term financial goal. That should merely be one step that gets you closer to your big picture life goal.

This is where our family purpose statement comes into play, because money is one part of many facets to our life. Creating your purpose statement helps you live simply, because as we believe here at this blog, living simply means just to live holistically with your life’s purpose.

So… What is your life’s purpose? When you find it, you’ll find the motivation you need to live according to your financial plan, even when it’s tough. You’ll be better able to make those daily little choices that ultimately add up to serious financial progress.

Think big…. Where would you like to be in five years? In 10? In 20? How would you like to spend your retirement years?

The “baby steps”

The following is the plan prescribed by Dave Ramsey. I don’t agree with everything he says, but I do recommend reading his main book, The Total Money Makeover and taking his course, Financial Peace University (we took it online when we lived overseas).

Step 1: $1,000 baby emergency fund

The biggest hurdle towards long-term financial freedom is paying off debt. But it’s not smart to pay off debt with absolutely no safety net. That’s why the first step is to very quickly save $1,000 as a baby emergency fund.

Yes, this is a safety net with incredibly large holes. It’s not much money. That’s intentional, though. It’s supposed to light a big enough fire under your pants to get you seriously fired up about paying off your debt as quickly as possible. When you know you’ve only got a thousand bucks for a potential emergency, you’ll want to pay off your debt as quick as possible, so you can get on with saving much more money.

There are a few exceptions to the $1K cap. If you know a storm is coming, it’s wise to sock away more money—examples of this are if you’ve got a baby on the way, if the primary breadwinner is out of work, or if someone in your immediate family is chronically ill. In this case, pay the minimums on your debt and just sock away any extra money.

However, when the storm passes, use all but the $1,000 and put it towards Step 2.

Step 2: Get out of debt

Once you’ve got a thousand dollars saved in the bank, it’s time to start paying off all debt but the mortgage. I’ve written about how we got out of debt, so I won’t rehash it here. But I will reiterate, as someone several years on the other side of debt-free living, that it’s so, so very worth it.

When you don’t owe anything to anyone, you’re free to make important decisions based on things other than money. Perhaps you can move somewhere based more on lifestyle choice than job market, or you can take a lower-paying job doing something you love.

When you’re debt-free, you don’t have to live in the past. You can live in the present and fully plan for the future.

The thing is, you have to really and truly want to be debt-free for this step to work. You have to be so sick and tired of debt that you’ve drawn a line in the sand to say no more. It’s not easy because it requires sacrifice. And it’s not a lot of fun.

But it is the grown-up thing to do. It’s financially responsible. And you may be surprised that once you start, the glimmer of spending money dulls. It’s just not that fun to spend money on frivolity. It’s more fun to assassinate those debts, one at a time.

Step 3: Finish your emergency fund

Once you’re debt-free (hooray!), you then return to that baby emergency fund and transform it in to a Big Daddy emergency fund. Typically, this is three to six months of expenses (not income), and it’s the essential expenses at that. What do you need to live on?

I was surprised at how quick this step was for us. Once we became debt-free in April ’09, we planned to fully fund our emergency fund by December. Instead, we were done by August, and continued to save afterward to fund a trip to Paris for that Thanksgiving.

I’ve heard from several people that this steps took less time than they thought as well. Perhaps it’s simply natural to take that intensity, fresh from paying off debt, and aim it towards that savings account.

It was a blast to watch the money, that was just recently leaving our bank account, instead stay in our pockets and pile up. Lattes and eating out could wait just a few more months.

(Steps 3b, c, and so on)

Once you’ve got your fully-funded emergency fund, you can keep saving for additional extras, if you like. This is when we saved for our vacation. You might also want to start saving for a vehicle replacement, a down payment, or home improvement projects.

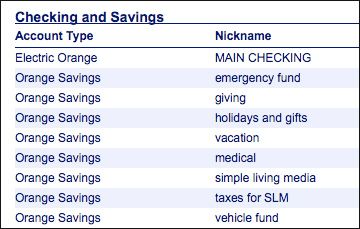

We found the best way to do this was by opening separate savings accounts for each of these goals, then automatically withdrawing a set amount from our main account each month until we reached the goal (this is also called “sinking funds”).

We use and love Capital One 360 because we can open unlimited savings accounts, and because it’s an Internet-only bank, it’s got a slightly higher interest rate on both savings and checking accounts (though not much).

Our account names change as our savings goals change, but the idea has stayed the same—various amounts get automatically transferred to each of our savings accounts, making it super easy to quickly save up for smaller items.

If you don’t yet have an account with Capital One 360 and would like to give them a whirl, head here to get started.

Step 4: Put 15% towards retirement

In Step 4, you start saving 15 percent of your income towards retirement. You’re supposed to put a hold on all retirement contributions during steps 1-3, which should seriously fire you up about plowing through those so you can get back to your retirement contributions.

You can lessen up on your gazelle intensity a bit here, saving for retirement while you work on your sinking funds (steps 3b and on), your kids’ education (step 5 below), and paying off your home (step 6). In other words, now you start the remaining baby steps at the same time.

Step 5: Save for your kids’ education

In Step 5, you start funding your kids’ higher education fund. The directive here is pretty simple, so I’ll just add one thought here.

Note that although you can do Steps 4 and on simultaneously, retirement does come before kids’ education in the Baby Steps. As a parent, it’s a generous gift to send our children to college, but it’s not a requirement, nor the definition of good parenting. If your kids ultimately have to pay for some of their education out of pocket, that’s okay.

However, no one can save for your retirement but you. Not your children, not the government. In fact, saving for your own retirement is a gift to your children.

Step 6: Pay off your house

After you’ve got your fully-funded Emergency Fund, after you’ve started saving 15 percent of your income towards retirement, and after you’ve started investing in your kids’ education, then it’s a good idea to throw all extra money towards paying off your home early.

Can you imagine having a paid-for home? Think of what you’d do with that money normally put towards your mortgage or rent. Think of how quickly your investments add up.

Another plan, if you love the taste of being debt-free so much you can’t imagine signing on for debt again (even if it is a mortgage), is to save up 100 percent for a house. Yep, a house paid for in cash. Read how Crystal did it.

Step 7: Live like no one else

This is the grand finale. You’re saving up for retirement and your kids’ college, you’ve got a paid-for house, and you’ve got at least six months of expenses in your emergency fund. What do you do?

This journey isn’t easy; the character built during the years of sacrifice usually mean that by the time you get to the big goal, your idea of what you’d do with all this disposable income has changed.

So what would you do?

Yes, making these steps require the “b” word—a budget. In order to succeed with these bigger picture goals, you’ve got to make it work day-by-day. Paying off your debt snowball requires snowflakes. And you and your spouse need to regularly communicate about what’s going on with your money.

This is where the rubber meets the road—making healthy choices about how we spend our money.